By Lawrence G. McMillan

With the “fiscal cliff” dominating the news, the media tries to link every market wiggle to what some politician has just said about it. Meanwhile, there are plenty of real market forces that are influencing the stock market, but those seem to only be of interest to participants who aren’t media addicts – i.e., only a few. It is our contention that these “real” factors are what is actually driving the market.

By Lawrence G. McMillan

We keep track of “90% days” with a great deal of accuracy. A “90% up day” is, in its purest form, a day when advancing issues outnumber declining issues by at least a 9-to-1 ratio and advancing volume outnumbers declining volume by at least a 9-to-1 ratio.

By Lawrence G. McMillan

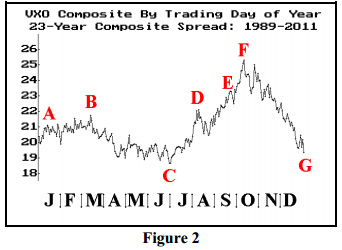

We occasionally publish charts showing the seasonal pattern of $VIX. Figure 2 below shows the composite price of $VIX for a 23-year history (1989 through 2011). This chart is constructed simply by following this method: gather the 23 $VIX prices for the first trading day of the year, sum them, divide by 23, and that is the first point to plot on the left of the graph. Continue that way throughout the year.

By Lawrence G. McMillan

The fall of the year is a time when we trade two of our better seasonal patterns – The (month-end) October Seasonal buy and the Heating Oil Gasoline spread. In fact, it is nearly time to implement a strategy for the October Seasonal Buy – if we are going to (last year, we passed on taking a position, and that was the correct call; will this year be different?). In this article, we’ll take a more in-depth look at both of these.

By Lawrence G. McMillan

What is interesting to one person may not necessarily be interesting to another. For example, I find it interesting that Joe Girardi finally had the guts to pinch-hit A-Rod, thus paving the way for Raul Ibanez to become an instant hero. Others couldn’t care less. So, the topics I’m going to discuss in this article are ones that I find interesting; I have no idea if everyone will or not.

By Lawrence G. McMillan

We often say that it is positive for an emerging bull trend to get heavily overbought – that this is an indication that the rally is strong and broad. In this article, we’re going to put that statement to the test by identifying (and quantifying) severely overbought markets and seeing how they performed up to 100 trading days later. This should provide some solid evidence of whether we need to relish or fear a severely overbought market.

By Lawrence G. McMillan

As traders and investors express more of an appetite for derivative products, the research departments at the exchanges (primarily the CBOE) and at various creators of ETFs (Proshares, First Trust, Rydex, etc.) have been busily designing new products. In this article, we're going to look at a few that have recently been announced. There are probably many more, but these are receiving a certain amount of new publicity at this time.

By Lawrence G. McMillan

For quite some time now (perhaps since last November), we have been pointing out how the voracious appetite for volatility protection has had the effect of distorting the term structure of the $VIX futures. Recently, though, this activity has branched out in a way that is only rarely seen in the markets: in short, large institutional traders are both buying stocks and buying volatility ETNs (thus, by inference, they are buying $VIX futures).

By Lawrence G. McMillan

In a continuation of the irregular series, explaining our analytical techniques, we are going to discuss how we interpret put-call ratio charts. This series began two issues ago with an article on naked put selling. Future articles in this series will encompass other aspects of position selection: calendar spreads, volatility skew-based trades, ratio spreads, and so forth.