By Lawrence G. McMillan

We got the breakout to new intraday and new closing highs that we were looking for. Now, the object for the bulls is to hold onto the gains. In that regard, we want to see a consecutive close above the old highs (2135) again today. This morning, $SPX looks to open about 10 points higher, so that is constructive. It’s been a long time since we’ve been at new all-time highs, but one thing about being here is that there is no natural overhead resistance. In the past, we’ve used the “modified Bollinger Bands” – the upper Bands, specifically – to estimate resistance. They also serve as targets for the mBB buy signal that is in effect. The +3σ Band is at 2163, and the +4σ Band is at 2190.

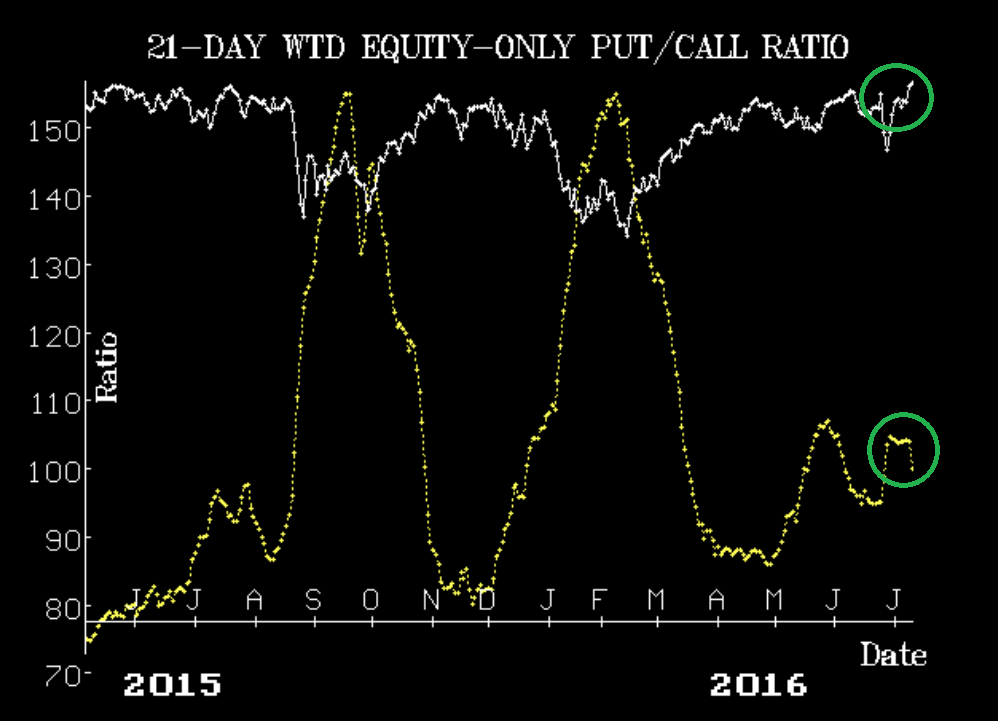

Equity-only put-call ratios are now both on buy signals, since the weighted ratio dropped sharply yesterday, thereby getting in synch with the standard ratio, which had rolled over to a buy a couple of days ago. The Total put-call ratio remains on its buy signal as well. The target for that signal (a 100-point gain in $SPX) is 2205...

This excerpt was part of the market commentary featured in this morning's edition of The Daily Strategist. Sign up for a free 7-day trial today to read the article in its entirety.

© 2023 The Option Strategist | McMillan Analysis Corporation