By Lawrence G. McMillan

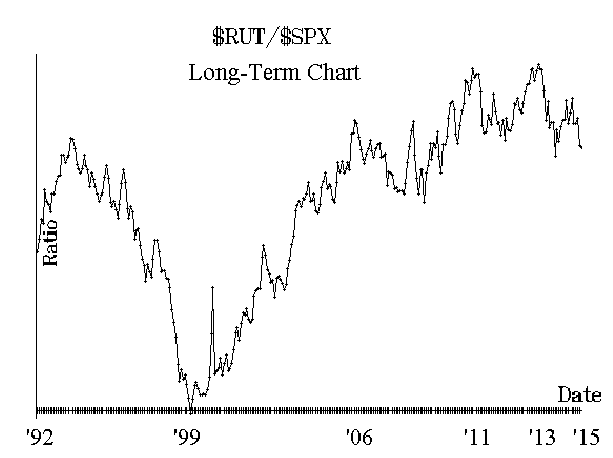

There has been a fair amount of talk lately about how large capitalization stocks are the main reason that this market is still near all-time highs, in terms of the larger indices. There is some truth to this statement, but we will look at a historical perspective as well. There have been some rather preposterous statistics in this regard cited on TV, and I have no way of knowing if they’re true or not. But the general thesis is that the market is being held together by a few stocks, and when they correct, the whole market will incinerate.

There is a rule of thumb that when the “Generals” are out front and leading the charge, that is bad for an Army and is bad for the stock market (where the “Generals” are General Motors, General Electric, etc. – a reference to a previous time when those stocks were the accepted market leaders). But this remains true: if only a small section of large caps is leading the stock market, a collapse will eventually follow.

Perhaps the most famous occurrence of this sort of thing occurred in the early 1970's, when the “Nifty Fifty” seemed to be impervious to any decline, and were lifting the Dow steadily higher. Eventually, though, the bear market of 1973-1974 ripped into those stocks, and stocks suffered nearly a 50% decline. Polaroid, for example, fell 91% in the bear market, while Xerox fell 71% and Avon 86%...

Read the full feature article (published 11/130/2015) by subscribing to The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation