By Lawrence G. McMillan

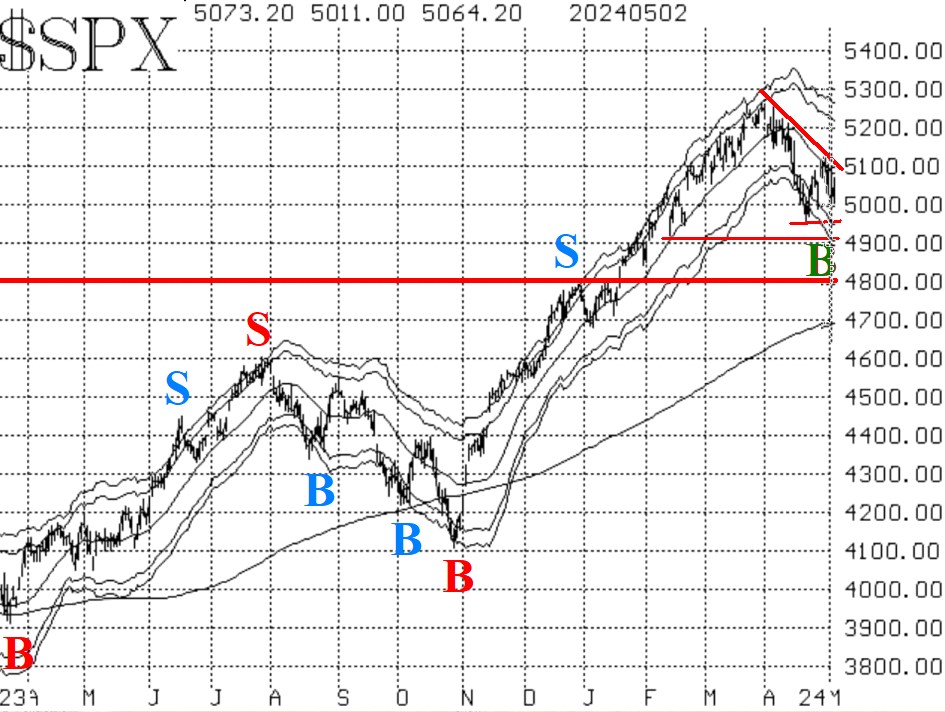

The oversold rally that began in late April swiftly reached the declining 20-day Moving Average of $SPX, and that is typically about the extent of such rallies. True to form, the Index fell back sharply from there. This reinforces a negative interpretation of the $SPX chart, for there is now a downtrend in place (roughly along the route of the declining 20-day Moving Average). Overheard, there is resistance at 5150-5180 and then at the all-time highs of 5260.

The first support level is 4940 where the oversold rally arose from. Below there is a minor support level at 4840, and then the major support at 4800.

It would have seemed that the bears would have taken the opportunity to test those support levels, but new buying has come in, and buy signals may be setting up.

There is a McMillan Volatility Buy (MVB) buy signal in place (green "B" on the chart in Figure 1).

Equity-only put-call ratios remain on sell signals for stocks, as they continue to rise. They rose steadily throughout the oversold rally in $SPX. In any case, they are still bearish now and will continue to be so until they roll over and begin to trend downward.

Breadth had a strong week, and both breadth oscillators are back on buy signals now, as they have moved back above +200. These oscillators have been swinging back and forth with abandon recently, so we do not have a position in place based on them.

$VIX continues to have two opposing signals. But if $VIX closes below its 200-day Moving Average (Currently just below 15), that would be a bullish sign.

In summary, we continue to maintain a "core" bearish position because of the negative $SPX chart (downtrend, with all the Bands and moving averages declining), and because of the equity-only put- call ratio sell signals. However, we will trade all other confirmed signals around that "core" position.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation